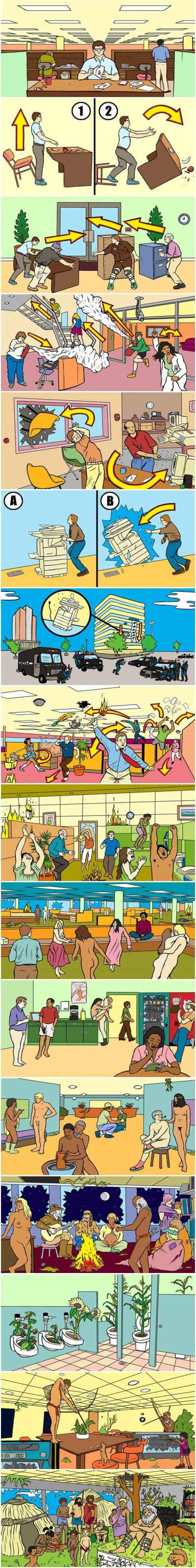

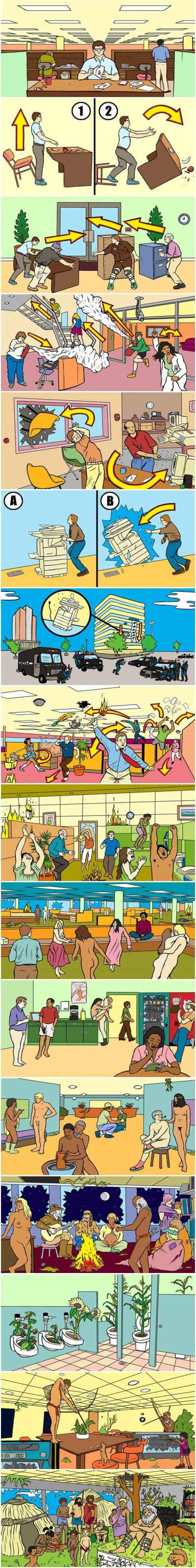

Someone posted this in QT3 in a thread to discuss news of workers rioting at a factory in the U.S. after getting news of being laid off. It looks more like an environmentalist revolution than a socialist one to me though. Enjoy!

Someone posted this in QT3 in a thread to discuss news of workers rioting at a factory in the U.S. after getting news of being laid off. It looks more like an environmentalist revolution than a socialist one to me though. Enjoy!

One blog that I’ve recently added to my regular reading list is De Minimis. I have no idea who the blog author is, but on general business and economic matters, I happily concede that he (I assume that the author is a “he”) is far more learned and well read that I am. He even appears to be a Star Trek fan, what a nice coincidence!

I’m pretty unhapppy about a post he made however. It’s an interview with PBB group chairman Datuk Oh Siew Nam about what measures Malaysia should take in the face of the current economic downturn. What upsets me is that in addition to the expected suggestion of a generously funded and carefully targeted stimulus plan, there are also two proposals that are explicitly protectionist in nature, and De Minimis appears to agree with both of them.

I found this Visual Guide to the Financial Crisis on mint.edu which I think is absolutely essential reading for anyone who is still bewildered over what’s happening. If you don’t have the time or can’t muster the attention to read lengthy analysis pieces and papers on the events leading up to where we are now, this makes for a decent, easy to understand, summary.

With the news of Citigroup getting guarantees worth US$300 billion in addition to a direct bailout from the TARP funds, there goes hopes that the financial crisis is coming to an end. Remember that not so long ago, before its share price got heavily hit by the mess, CItigroup was the biggest bank in the world by stock market capitalization. As Crooked Timber noted, not only is Citigroup the very definition of “too big to fail”, it’s so big that not even the mighty U.S. government could save it if it goes down.

Here’s a couple of links to some of the best articles on the crisis that I’ve read. A short history of modern finance from The Economist explains the two demonized financial instruments at the heart of the crisis, Collaterize Debt Obligations and Credit Default Swaps from a historical perspective. The article not only explains how they work, but also when and why they were invented and what purposes they serve in finance.

The End of Wall Street’s Boom published by Portfolio and written by Michael Lewis who gained famed for his 1989 tell-all book Liars’ Poker about the bond market. This article covers the boom and bust of the subprime mortgage market from the perspective of various industry insiders.

I love the wonderful, wonderful irony in this. Apparently a large group of Christians organized a mass prayer at banks, stock markets and other financial institutions all over the world to ask for God’s intercession into the current financial mess. Here’s an excerpt from the original call to prayer as reported by the Christian Broadcasting Network:

For these and other reasons Cindy is calling for a Day of Prayer for the World’s Economies on Wednesday, October 29, 2008. They are calling for prayer for the stock markets, banks, and financial institutions of the world on the date the stock market crashed in 1929. They are meeting at the New York Stock Exchange, the Federal Reserve Bank, and its 12 principal branches around the US that day.

“We are going to intercede at the site of the statue of the bull on Wall Street to ask God to begin a shift from the bull and bear markets to what we feel will be the ‘Lion’s Market,’ or God’s control over the economic systems,” she said. “While we do not have the full revelation of all this will entail, we do know that without intercession, economies will crumble.”

The photo above, taken from Wonkette, is of the said group praying at the aforementioned bull statue on Wall Street. The irony is obvious to anyone with even a passing knowlege of the Bible since the bull statue on Wall Street is a huge golden bull, and instantly brings to mind the story of the Golden Calf from the book of Exodus. As the Wikipedia entry indicates, one interpretation of the story, apart from the more obvious one as an example of the sin of idolatry, is that it was intended as a Biblical criticism on the pursuit of material wealth. A double irony indeed.

I can only guess that these Christians haven’t been reading the Bible much.

Two weeks ago, I wrote a blog post saying if any public official in the U.S. ought to be blamed for the current mess in the financial markets, it ought to be Alan Greenspan, the former Chairman of the Federal Reserve. A couple of days ago, at a Congressional hearing, Greenspan admitted that he had made mistakes, while stopping short of taking full responsibility. He also admitted that he had failed to take action earlier for idealogical reasons, believing that the markets would be self-correcting.

It’s a bad time to believe in capitalism. As a poster on QT3 remarked, Greenspan was “like BFF with Ayn Rand and everything”. Hopefully, I’ll have time to write a spirited defense of capitalism next week.

This is as good a time as any to post a link to Sad Guys on Trading Floors, a photo collection of traders’ reactions to the continuing financial meltdown. The U.S. Federal Reserve just dropped the federal funds rate by 0.5 percent to 1.5 percent, while central banks around the world followed suit, and the markets still dropped. The U.S. Treasury stated that it might have to take ownership of U.S. banks and U.S. House Speaker Nancy Pelosi has just announced a proposal for yet another stimulus package worth US$150 billion to be spent in a Keynesian attempt to jump start the American economy. All of that is just today’s news.

Remember how AIG was bailed out by the U.S. government to the tune of US$85 billion just a couple of weeks ago and needed another US$37.8 billion yesterday? A report today details a week long “conference” organized by the world’s largest insurer for its top agents at a five-star resort in California costing more than US$400,000.00 just a few days after the first bailout. As the saying goes, we live in interesting times.