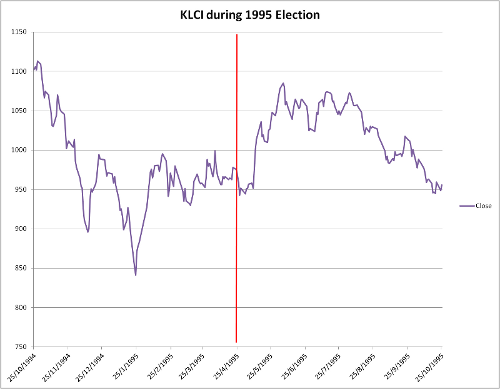

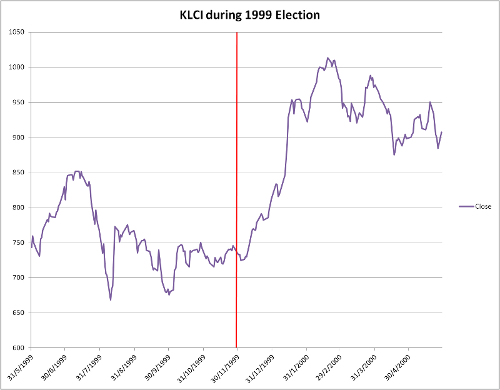

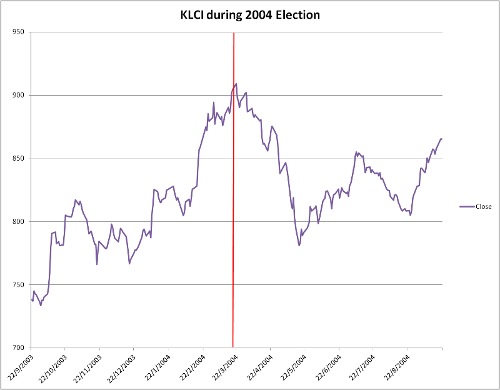

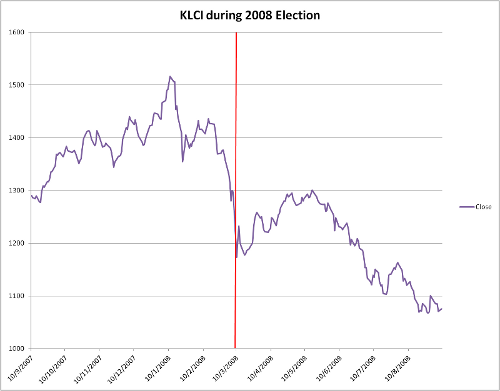

Strangely enough, despite being 36 years old this year, the upcoming Malaysian general election is the going to be the first one for which I will be in the country as an adult of voting age. Since Malaysian politics bore me in general so this post won’t be about that. Instead, this post will deal with a good question posted by someone in the general LYN stock market trading thread: historically speaking, how does the local stock market respond to elections? Are there any patterns at all? Out of curiosity, I spent some time making charts of the KLCI for the six months before and six months after each of the four previous elections. So here they are:

My methodology was pretty simple: grab voting dates from Wikipedia and historical KLCI closing values for the relevant dates from Yahoo. I then plotted the data in Excel. Here’s the file itself packaged in a zip container in case anyone wants to look over the work. Hopefully I didn’t make some kind of elementary mistake on it.

Looking over these charts, I don’t think there is any systematic pattern. The KLCI does tend to rally a bit soon after each election, but I think those effects are outweighed by economic fundamentals. Short-term traders might be interested in taking advantage of the small pre-election dips in expectation of a post-election rally, but to longer-term investors like myself, I don’t expect the differences to be that significant.

On the ground however, the news is that the EPF has been disposing of massive quantities of local stocks. Buyers appear mostly to be foreign funds. And Tony Pua has claimed on Facebook to have noticed a trend of large shareholders in government-linked companies selling off their stakes. There are two popular interpretations:

- The owners of GLCs, generally perceived to be cronies of the ruling coalition, are getting nervous about the prospects of the opposition actually gaining control of the federal government this time and are selling their stakes in anticipation.

- The selling off is meant to generate cash that will be funneled to politicians to fund their election campaigns.

Either way, it seems likely that the market will be flat or bearish in the run-up to the elections, so investors with cash in hand might want to wait for bargains. This is also what I am doing personally. As for the post-election situation, given that there appears to be a real, if slight, risk of the ruling coalition losing the election this time around, I have no idea since this is uncharted territory for Malaysia. Personally, I am prepared to take the risk and buy if prices on blue chip companies drop low significantly. Let’s see what happens next.